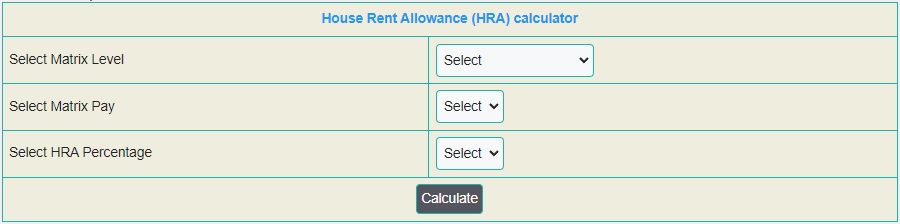

HRA Online Calculator 2023 after 7th CPC

HRA, or House Rent Allowance, is a frequently included component in Indian salary packages. This allowance aids employees in paying their rental expenses and is tax-free up to a set limit, making it a desirable part of the salary. The amount an employee is eligible for varies based on salary, city of residence, and rent paid.

In India, HRA is calculated as a percentage of basic salary with higher percentages for those residing in metro areas. Actual HRA received is also dependent on actual rent paid and cannot exceed the HRA percentage of basic salary. To claim HRA, an employee must provide evidence of rental payment for a residential property.

What is the meaning of HRA?

Employers provide HRA to their employees as a part of their salary to assist with expenses related to rental housing. Living in a rented house is a requirement for qualifying for HRA exemption. The exemption for HRA falls within the scope of Section 10(13A) and Rule 2A of the Income Tax Act, 1961.

What is House Rent Allowance in Salary?

The HRA is a tool that assists employees in covering their living expenses in the city where they work. It is considered as part of your salary, but a certain portion of the HRA is not subject to taxation under Section 10 (13A) of the IT Act of 1961, with specific conditions in place. Your employer determines the amount of HRA provided to you based on factors that include your salary structure, compensation level, and location of residence. You can communicate with your employer to confirm that you are receiving the maximum tax benefits allowed under the Income Tax Act.

What is the current rates of HRA?

The rates for HRA are subject to change based on the percentage of Dearness Allowance (DA). At present, the rates proposed by the 6th Central Pay Commission provide 30% of basic pay + grade pay + military service pay + NPA for residents in Class X cities, 20% for Class Y cities, and 10% for Class Z cities. However, when the DA exceeds 25%, the HRA rates will be updated to 27%, 18%, and 9% for X, Y, and Z class cities correspondingly. Additionally, when the DA reaches 50%, further revisions to 30%, 20%, and 10% will be established.

What are the benefits of HRA for Govt Employees?

The compensation package of Central Government employees includes House Rent Allowance (HRA), which covers the expenses related to rental housing. The rates of HRA are categorized into X, Y, and Z based on the city classification. Effective July 1st, 2021, the HRA rates for each city category are 9% (Z Class), 18% (Y Class), and 27% (X Class). Employers determine the allocated amount of an employee’s basic salary towards this allowance based on the city the employee is located in. Calculating HRA in salary is a straightforward process. For instance, if an employee’s basic salary is Rs. 49000, their HRA would be 27% (Rs.13230), 18% (Rs. 8820), and 9% (Rs. 4410) for X, Y, and Z categories, respectively.

When will increase HRA to 30 percent?

On July 1, 2021, the House Rent Allowance (HRA) for Central Government Employees underwent a revision. Another revision will take place in 2024 when the DA percentage mark of 50% has been achieved. If the dearness allowance increase reaches 50 percent or more, the HRA will be raised from 27% to 30%. The Department of Personnel and Training has outlined that the HRA will become 30%, 20%, and 10% when the dearness allowance crosses 50%, as per a memorandum. When the DA surpasses 25%, the HRA in X, Y, and Z cities will be increased to 27%, 18%, and 9% of Basic Pay, followed by an increase to 30%, 20%, and 10% of Basic Pay in the same cities when the DA reaches 50%.

What is the minimum rate of HRA?

Over 700,000 workers will reap the benefits of an increased minimum HRA. The adjusted HRA rates guarantee a minimum sum of Rs.5400 for X-class cities, Rs. 3600 for Y-class cities, and Rs. 1800 for Z-class cities. The minimum HRA amount of Rs. 1800 is equivalent to 10% of the minimum basic pay.

Classification of Cities for HRA after 7th CPC

The classification of cities for HRA after the 7th CPC is based on population records. Indian cities are divided into three categories: X, Y, and Z. The State-wise list of X, Y, and Z class cities can be found below. X and Y class cities and towns are eligible for 24% and 16% HRA respectively, while other cities fall under the Z class. For instance, Hyderabad in Andhra Pradesh and Telangana is an X city with a 24% HRA, whereas Vijayawada, Warangal, Greater Visakhapatnam, Guntur, and Nellore are classified as Y cities with a 16% HRA. Bhubaneswar and Cuttack are among the Y class cities in Odisha.

In Delhi, there is only one X city, Delhi itself, with a 24% HRA. In Gujarat, Ahmedabad is the only X city, while Rajkot, Jamnagar, Bhavnagar, Vadodara, and Surat are Y cities with a 16% HRA. Among the Y cities in Haryana are Faridabad and Gurgaon, both with a 16% HRA. Bangalore/Bengaluru is an X city with a 24% HRA in Karnataka, whereas Belgaum, Hubli-Dharwad, Mangalore, Mysore, and Gulbarga are Y cities with a 16% HRA.

Greater Mumbai and Pune are the only X cities in Maharashtra. The others, such as Amravati, Nagpur, Aurangabad, Nashik, Bhiwandi, Solapur, Kolhapur, Vasai–Virar City, Malegaon, Nanded-Vaghela, and Sangli, are all classified as Y cities with a 16% HRA. Punjab has Amritsar, Jalandhar, and Ludhiana, all Y cities. In Rajasthan, Bikaner, Jaipur, Jodhpur, Kota, and Ajmer are Y cities.

Chennai is the only X city in Tamil Nadu, while Salem, Tiruppur, Coimbatore, Tiruchirappalli, Madurai, and Erode are Y cities with a 16% HRA. Moradabad, Meerut, Ghaziabad, Aligarh, Agra, Bareilly, Lucknow, Kanpur, Allahabad, Gorakhpur, Varanasi, Saharanpur, Noida, Firozabad, and Jhansi are all Y cities in Uttar Pradesh. Finally, Kolkata is the only X city in West Bengal, while Asansol, Siliguri, and Durgapur are Y cities with a 16% HRA. Note that Saharanpur was reclassified as a Y class city with effect from June 2011.

HRA Exemption from Income Tax

Discover How to Calculate HRA Exemption for Income Tax: Are you a salaried worker aiming to avail of an exemption from Income Tax on your HRA (House Rent Allowance)? If that’s the case, you have an advantage! In line with Income Tax Regulations 10(13A) and Rule 2A, you can claim exemption on the smallest amount of the following:

– Your actual HRA received in your salary

– 40% of your salary (Basic Pay + DA) for Non-Metro cities

– 50% of your salary (Basic Pay + DA) for Metro cities like Mumbai, Calcutta, Delhi or Chennai

– Rent paid minus 10% of your salary

However, if you’re residing in your own house or not paying any rent, you will not be qualified to obtain the exemption on HRA. Fortunately, our HRA Exemption Calculator can help you estimate the precise amount of exemption you can get. Hence, use our calculator and enjoy an income exempted from taxes with HRA exemption.

7th Pay Commission New HRA Table

HRA Rates for Pay Matrix Level 1

| 7th Pay Commission Pay Matrix Level 1 (Grade Pay 1800) | ||||

| Index | Basic Pay | HRA 8% (Z Class Cities) | HRA 16% (Y Class Cities) | HRA 24% (X Class Cities) |

| 1 | Rs. 18000 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 2 | Rs. 18500 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 3 | Rs. 19100 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 4 | Rs. 19700 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 5 | Rs. 20300 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 6 | Rs. 20900 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 7 | Rs. 21500 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 8 | Rs. 22100 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

HRA Rates for Pay Matrix Level 2

| 7th Pay Commission Pay Matrix Level 2 (Grade Pay 1900) | ||||

| Index | Basic Pay | HRA 8% (Z Class Cities) | HRA 16% (Y Class Cities) | HRA 24% (X Class Cities) |

| 1 | Rs. 19900 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 2 | Rs. 20500 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 3 | Rs. 21100 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 4 | Rs. 21700 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 5 | Rs. 22400 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

HRA Rates for Pay Matrix Level 3

| 7th Pay Commission Pay Matrix Level 3 (Grade Pay 2000) | ||||

| Index | Basic Pay | HRA 8% (Z Class Cities) | HRA 16% (Y Class Cities) | HRA 24% (X Class Cities) |

| 1 | Rs. 21700 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

| 2 | Rs. 22400 | Rs. 1800 | Rs. 3600 | Rs. 5400 |

Who is eligible for HRA?

HRA is applicable to all Central Government employees in India.

How is HRA calculated?

HRA is calculated as a percentage of the employee’s basic salary. The percentage is determined by the government and is generally between 9% and 30%.

When will the HRA be increased?

The HRA will be increased once the dearness allowance hike reaches 50%.

Leave a Reply