TN Pongal Bonus 2023

The Tamil Nadu Pongal bonus is a financial incentive given by the state government to its employees every year! It is usually announced during the harvest festival of Pongal and is meant to provide financial relief to the people of Tamil Nadu. The bonus amount varies from year to year, but it is usually around Rs. 3000 per person. This year 2023, the Tamil Nadu State Government declared the Pongal Gift as Rs. 300 to its employees!

The State Government of Tamil Nadu grants a special Pongal Prize for its employees and pensioners every year on account of the Pongal Festival. All State Government employees working in C and D categories are eligible to get a Pongal Bonus of Rs. 3000. And also the State Government pensioners to get a Pongal Parisu Rs.500. All State Government employees and Pensioners are waiting for the announcement of the year 2023!

Last year the Pongal Bonus order has been published on 1st January 2022 by the Finance (Pension) Department of Tamil Nadu. The State Government has decided to grant Adhoc Bonus to celebrate the harvest festival “Pongal” equivalent to 30 days emoluments subject to a ceiling of Rs.3,000 to all C and D Group regular and temporary Government employees, employees of Local Bodies, and Aided Educational Institutions including teachers on regular time scales of pay and Special Adhoc Bonus of Rs.1000 to full time and Part time employees paid from contingencies/employees paid from Special time scale of pay.

The Ad-hoc Bonus shall be computed on the basis of actual emoluments as on 31st March 2021. The amount of the ad-hoc bonus shall be calculated as if monthly emoluments were Rs.3,000 per month. In respect of those drawing pay in the pre-revised / revised scales of pay, the calculation of the Ad-hoc bonus shall be based on the emoluments drawn subject to the upper ceiling limit of Rs.3,000 per month.

Government sanction a lumpsum Pongal Prize amount of Rs.500 to all Government Pensioners who retired from the categories of C and D Group (C and D Group of Scales of Pay (Ordinary Grade) is annexed to this order) including all C and D Group of Pensioners of Aided Educational Institutions, Local Bodies, Ex-Village Establishment (Ex-Village Officers and Village Servants-Assistants), Ad-hoc Pensioners of all categories (Pensioners those who are drawing Special Pension of Rs.2,000 with effect from 1-10-2017 i.e. Noon Meal Organisers, Anganwadi Workers, Mini Anganwadi Workers, Cooks, Cook Assistants, Anganwadi Helpers, Panchayat Secretaries, Village Librarian, Sweepers, Sanitary Workers, Scavengers, Plot Watchers, Anti-poaching Watchers, Police Station Cleaners, Ayah) and to all Family Pensioners irrespective of the Groups from which the Pensioners, Deceased Government employee had retired, died while in service.

The State Government of Tamil Nadu will issue G.O. on Pongal Bonus for the year 2023 after the official announcement of Tamil Nadu Chief Minister M.K. Stalin.

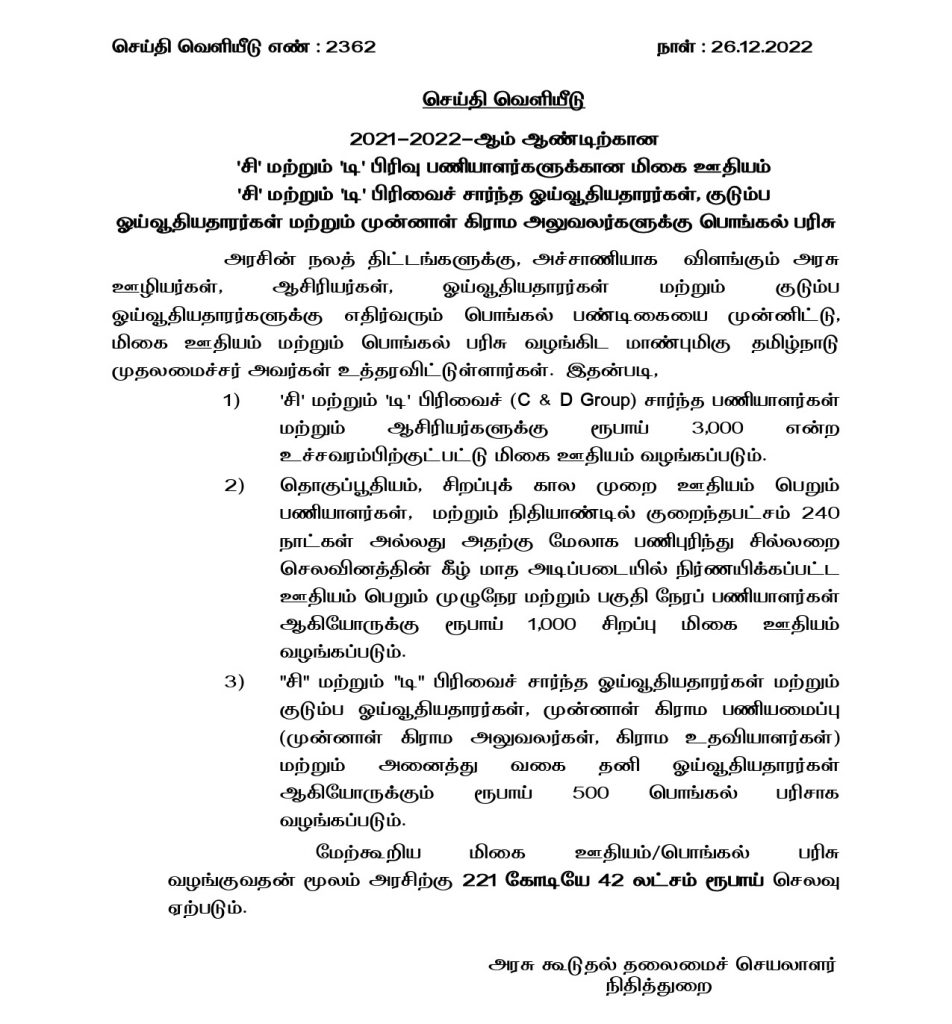

Tamil Nadu Pongal Bonus GO 373 for the year 2023: Ad-hoc Bonus for ‘C’ and ‘D’ Group Government employees

Government of Tamil Nadu

FINANCE [Allowances] DEPARTMENT

G.O.Ms. No. 373, Dated: 26th December 2022.

(Subakiruthu, Margazhi-11, Thiruvalluvar Aandu 2053)

ABSTRACT

Bonus – Payment of Ad-hoc Bonus and Special Ad-hoc Bonus for the Accounting Year 2021-2022 – Sanction – Orders – Issued.

ORDER:

Government has decided to grant Adhoc Bonus to celebrate harvest festival “Pongal” equivalent to 30 days emoluments subject to a ceiling of Rs.3,000 to all “C‟ and “D‟ Group regular and temporary Government employees, employees of Local Bodies and Aided Educational Institutions including teachers on regular time scales of pay and Special Adhoc Bonus of Rs.1000/- to full time and Part time employees paid from contingencies, employees paid from Special time scale of pay for the accounting year 2021-2022.

2. Accordingly, Government direct that all “C” and “D” Group regular and temporary employees who are on regular time scales of pay, employees of Local Bodies and Aided Educational Institutions including Teachers on regular time scales of pay in C and D Group be paid adhoc bonus equivalent to 30 days emoluments subject to a ceiling of Rs.3,000/- for the accounting year 2021-2022.

3. Government also direct that, Special Ad hoc Bonus of Rs.1,000/- be paid to full-time and part-time employees paid from contingencies at fixed monthly rates, employees on consolidated pay/special time scale of pay including employees in Nutritious Meal Programme/ Integrated Child Development Service (ICDS) Scheme (Anganwadi Workers /Mini Anganwadi Workers), Village Assistants, employees on daily wages and the employees partly worked on daily wages and subsequently brought under regular establishment and worked continuously for atleast 240 days or more during the accounting year 2021-2022.

4. The Ad-hoc Bonus shall be computed on the basis of actual emoluments as on 31st March 2022. The amount of ad-hoc bonus shall be calculated as if monthly emoluments were Rs.3,000/- per month. In respect of those drawing pay in the pre-revised, revised scales of pay, the calculation of Ad-hoc bonus shall be based on the emoluments drawn subject to the upper ceiling limit of Rs.3,000/- per month.

5. The Ad-hoc Bonus/Special Ad-hoc Bonus sanctioned above shall be admissible subject to the conditions prescribed in the Annexure to this order.

6. The expenditure on Ad-hoc Bonus/Special Ad-hoc Bonus shall be debited to the sub-detailed head “04. Other Allowances” under the detailed head “301. Salaries” or the detailed head “302. Wages” as the case may be, under the relevant service head of the department concerned.

(BY ORDER OF THE GOVERNOR)

N.MURUGANANDAM

ADDITIONAL CHIEF SECRETARY TO GOVERNMENT

ANNEXURE

[G.O.Ms.No.373, Finance (Allowances) Department, Dated: 26-12-2022]

(i) The emoluments for purposes of Ad-hoc Bonus under these orders shall be worked out on the basis of basic pay/ personal pay and dearness allowance as on 31st March, 2022. The eligible Government servants of C and D Group shall be as ordered in G.O.Ms.No.21, Personnel and Administrative Reforms (A) Department, Dated: 05-03-2019.

(ii) The employees who were in service on 31st March 2022 and have rendered a full year of service from 1st April 2021 to 31st March 2022 shall be eligible for the full amount of Ad-hoc Bonus sanctioned in this Order at the rate of 30/30 days of emoluments.

(iii) The employees who have rendered service of six months and above, but less than a year during 2021-2022 shall be eligible for proportionate amount of Ad-hoc Bonus. For the purpose of this rule, period less than 15 days shall be ignored and fifteen days and above shall be treated as a full month of service.

(iv) The Ad-hoc Bonus shall be rounded to the nearest rupee, i.e., fraction of 50 paise and above shall be rounded to the next higher rupee and fraction below 50 paise shall be ignored.

(v) The period of service for the purpose of computing Ad-hoc Bonus shall include all leave other than the extraordinary leave without Allowances. In the case of employees who were on extraordinary leave without allowances, Half Pay, Study Leave without pay during the month of March 2022, the Ad-hoc Bonus shall be determined based on the emoluments last drawn before proceeding on leave.

(vi) In the case of employees under suspension at any time, during 2021 – 2022 Subsistence allowances paid during suspension shall not be treated as emoluments. Such an employee may be paid Ad-hoc Bonus, Special Ad-hoc Bonus as and when the period of suspension is treated as duty. In other cases, the period of suspension shall be excluded for the purpose of Ad-hoc Bonus/Special Ad-hoc bonus. In the case of suspension, if any, after 31st March 2022 there shall be no bar for the payment of Ad-hoc Bonus, Special Ad-hoc Bonus.

(vii) Employees who retired on superannuation, Voluntary retirement, died in harness, invalidated from service, etc., prior to 31st March 2022 are eligible for Ad-hoc Bonus, Special Ad-hoc Bonus on the basis of actual service, subject to provision in para (iii) above.

(viii) Superannuated employees who were re-employed are eligible for Ad-hoc Bonus, Special Ad-hoc Bonus provided the period of service prior to and after re-employment taken together is not less than six months, subject to provision in para (ii) and (iii) above. In such cases, the eligibility period has to be worked out separately for the period prior to and after re-employment. The total amount admissible, for the period prior to superannuation and for the period after re-employment shall be restricted to the maximum admissible Ad-hoc Bonus, Special Ad-hoc Bonus; and

(ix) Employees who have rendered service of six months and above in Group “C‟ are eligible for proportionate Ad-hoc Bonus only. If an employee rendered less than six months of service in Group “C‟ and more than six months in Group “B‟, he shall not be eligible for Ad-hoc Bonus.

SECTION OFFICER

Click to view TN Pongal 2023 GO PDF Download

TN Pongal Bonus for Pensioners G.O. 2 Dated 1.1.2022 PDF Download